When Someone Has Died

When someone dies their estate will need to be dealt with. Their estate may consist of a variety of different assets such as their home, finances, personal belonging along with settling any outstanding debts and other liabilities such as household bills. The person who has the right to administer the deceased estate is called a personal representative (PR).

When someone dies their estate will need to be dealt with. Their estate may consist of a variety of different assets such as their home, finances, personal belonging along with settling any outstanding debts and other liabilities such as household bills. The person who has the right to administer the deceased estate is called a personal representative (PR).

If the person who has died had left a will, they will have appointed an executor/s. The executor is the PR. If a person has not left a will there is an order setting out who is entitled to apply to be the PR.

Depending on the value of the estate it is often necessary to apply for a grant. If the deceased owned a property a grant will be required to deal with the sale or assent (if it is left to someone under the will).

If you are dealing with the death of a loved one, we can assist you as much or as little as you want us to.

If the estate is fairly straight forward with only a few assets and beneficiaries, you may wish to deal with most of the administration yourself. We could assist in preparing the paperwork required for the grant to be issued from the Probate Registry. This is known as Grant of Probate application.

If the estate is more complex, or if you feel you need more support from our experts, we can assist you with the entire Estate Administration.

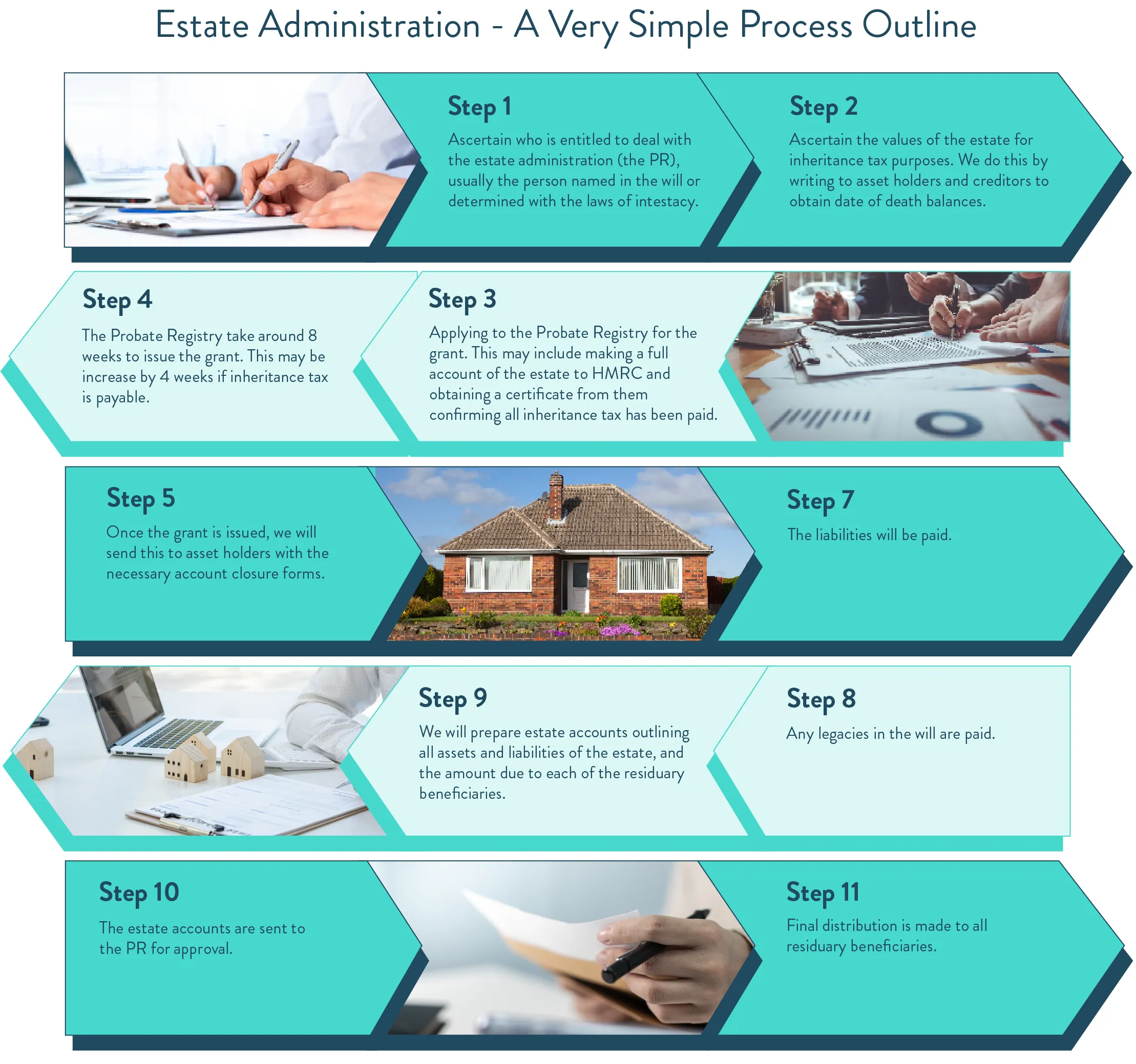

Process of Estate Administration

It takes quite a lot of time to deal with even a simple estate at a difficult time when you are grieving. You would still be named on the grant and would still be the PR of your loved one’s estate but if we carry out the estate administration we will take all the stress and worry from you and save you hours of time.

So what do we do?

- If your loved one did not leave a will, we can tell you who is entitled to apply for the grant and who will inherit the estate.

- We will value the estate, writing to all asset holders and creditors obtaining date of death balances.

- We can arrange for the funeral invoice to be settled directly from the bank account of your loved one.

- We will report the value of the estate to HMRC if required for inheritance tax purposes completing all the necessary forms.

- We will complete the statement of truth and additional paperwork to apply for the grant.

- Once the grant has been issued we will send this on to all asset holders along with closure forms which we will have completed in full.

- We will then gather in the assets of the estate.

- Pay the liabilities.

- Pay any legacies left in the will.

- Produce estate accounts, which will be approved by the PR’s before final distribution is made.

- Distribute the balance (known as the residuary estate) in accordance with the will or intestacy rules.

We offer Guaranteed fixed fees for dealing with estate administration.

To keep things simple, we will only request the information we need in order to progress your application for a grant.

We will need to see the death certificate, the will (if there is one) and your ID documents. We will send you a freepost secure postage bag to send the items to us.

We will also need some information regarding which companies your loved ones had accounts with.

Please get in touch with us so we can talk this through in more detail or call 0333 220 3095.

Get Started Today

Complete the form below to get started or call us on 0333 220 3095.

"*" indicates required fields